Account reconciliation is done to ensure that account balances are correct at the end of an accounting period. The account reconciliation process also helps to identify any outstanding items that need to be taken into consideration in the reconciliation process. For lawyers, reconciliation in accounting is essential for ensuring that financial records are accurate, consistent, and transparent. While proper reconciliation is the standard for how law firms should handle all financial accounts, it is particularly important—and often required—for the management of trust accounts. Bank reconciliation is an accounting process where you compare your bank statement with your own internal records to ensure that all transactions are accounted for, accurate, and in agreement.

- Deposits are money that the company receives, while checks are payments made by the company.

- When the process has worked well, it will have picked up on any inaccuracies or instances of fraud.

- Reconciliation for prepaid assets checks the balances for different types of prepaid assets, factoring in transactions like additions and amortization.

- Reconciling your bank statements allows you to identify problems before they get out of hand.

- It helps identify discrepancies caused by outstanding checks, unrecorded deposits, bank fees, or other timing differences.

For lawyers, account reconciliation is particularly important when it comes to trust accounts. In fact, most jurisdictions have requirements for trust account reconciliation. For example, you may need to reconcile your trust account bank statement with client balances at a specific frequency, such as monthly or quarterly.

Once the errors have been identified, the bank should be notified to correct the error on their end and generate an adjusted bank statement. A company may issue a check and record the transaction as a cash deduction in the cash register, but it may take some time before the check is presented to the bank. In such an instance, the transaction does not appear in the bank statement until the check has been presented and accepted by the bank. All trust transactions in the internal ledger should be accurately recorded and should align with transactions in the individual client ledgers. How often should you conduct the three-way reconciliation accounting process? As noted earlier, your state may have specific requirements for how often you must conduct three-way reconciliation—such as monthly or quarterly.

The Reconciliation Process

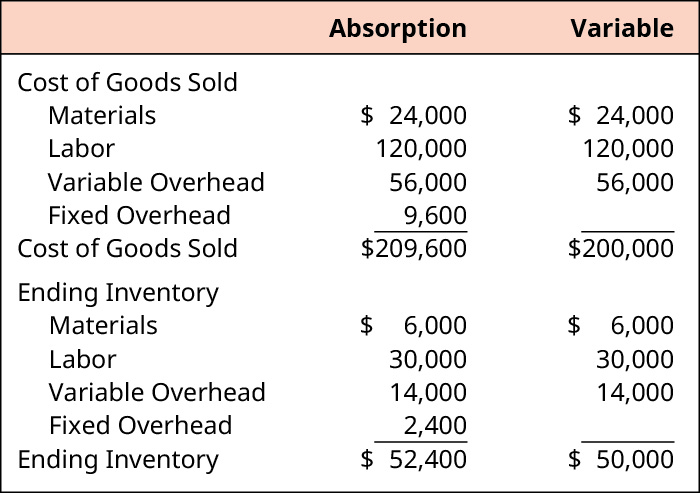

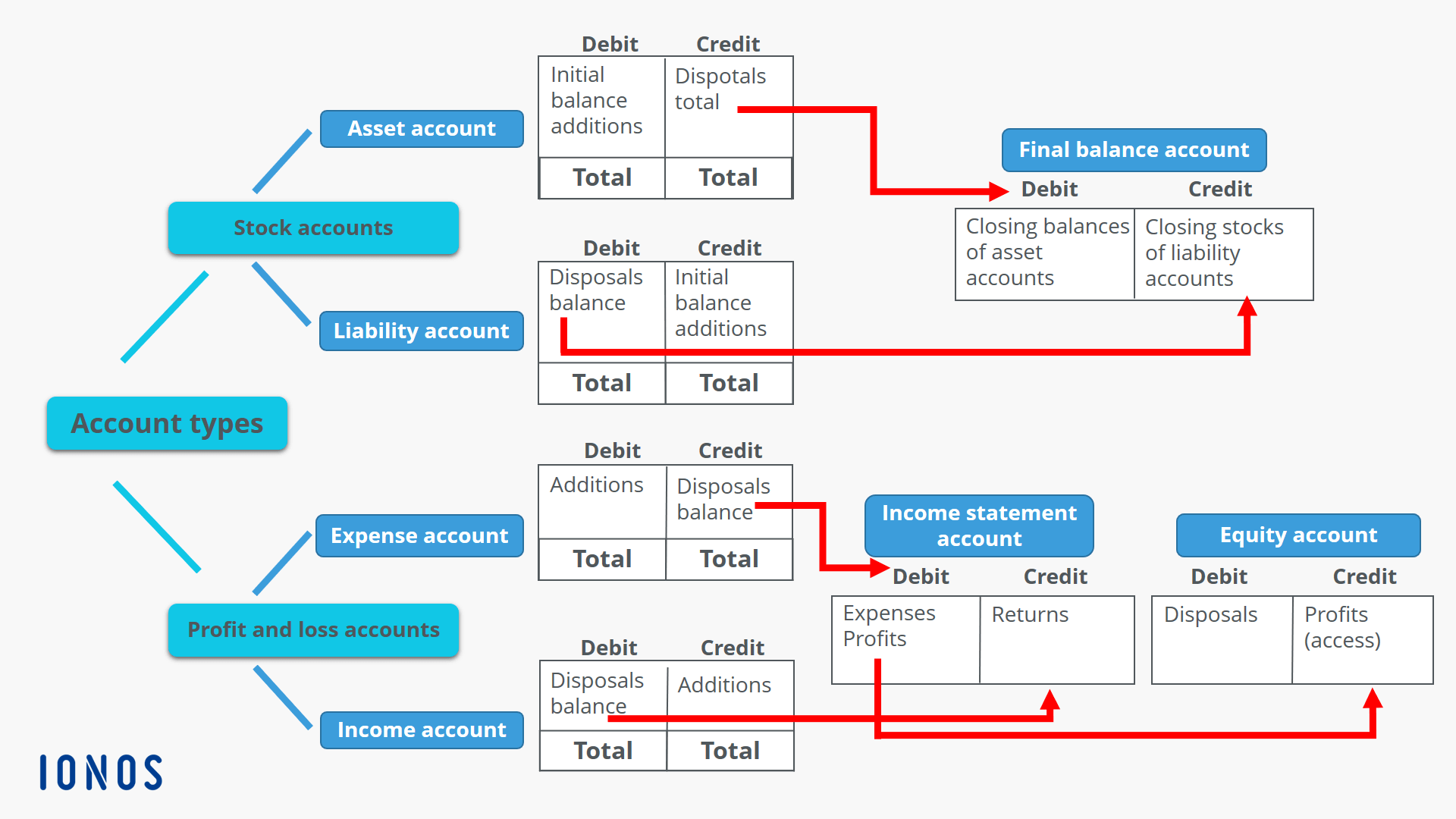

This is because the general ledger is considered the master source of financial records for the business. By performing reconciliations against the general ledger, the company can ensure that its financial records are accurate and up-to-date. The account reconciliation process can involve several financial accounts. Reconciling an account is an accounting process that is used to ensure that the prepaid expenses journal entry definition how to create and examples transactions in a company’s financial records are consistent with independent third party reports.

What Is the Difference Between Account Reconciliation and Financial Reconciliation?

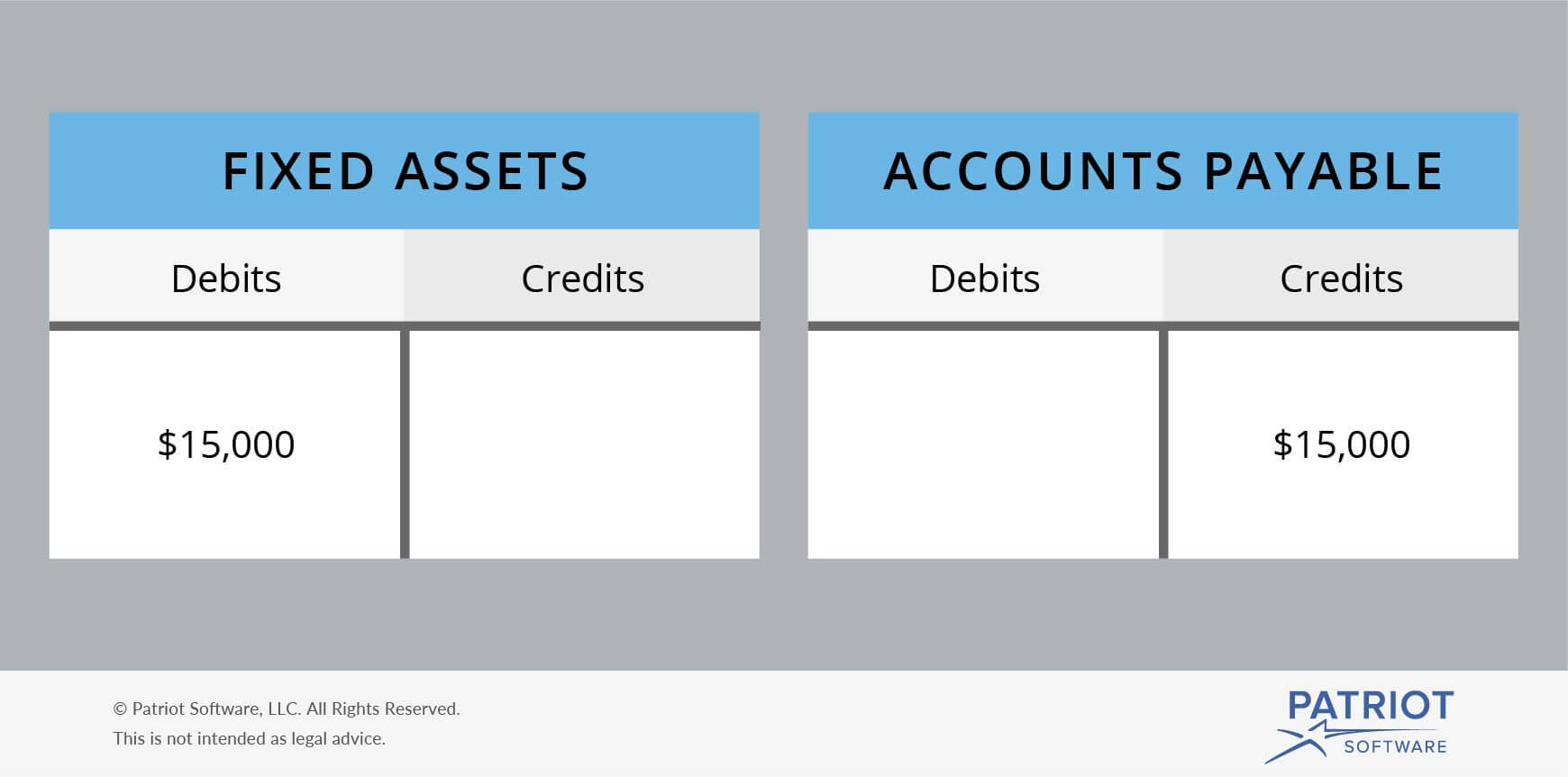

Balancing financial records is a fundamental principle in any company or business. Deposits and checks are transactions that affect the company’s bank account. Deposits au section 722 interim financial information are money that the company receives, while checks are payments made by the company. Bank reconciliation also helps to ensure that the company’s cash balance is accurate, which is crucial for making informed financial decisions.

Bank Reconciliation in Business Context

Tick all transactions recorded in the cash book against similar transactions appearing in the bank statement. Make a list of all transactions in the bank statement that are not supported, i.e., are not supported by any evidence, such as a payment receipt. For example, a company maintains a record of all the receipts for purchases made to make sure that the money incurred is going to the right avenues. When present value formula and pv calculator in excel conducting a reconciliation at the end of the month, the accountant noticed that the company was charged ten times for a transaction that was not in the cash book. The accountant contacted the bank to get information on the mysterious transaction.

What is the format of a bank reconciliation statement?

It will let you see if the goods you sold or services you provided match up with your internal records. Parent companies use this to bring together all the accounts and ledgers from the subsidiaries they may have. The process looks for mismatches both within and between any of the subsidiaries. These will then get submitted to their accounts receivable ledger records. Lastly, in the United States, account reconciliation is crucial to help companies comply with federal regulations applied by the Securities and Exchange Commission (SEC) under the Sarbanes-Oxley Act.