For example, the computers that Apple, Inc. intends to sell are considered inventory (a short-term asset), whereas the computers Apple’s employees use for day-to-day operations are long-term assets. In Liam’s case, the new silk screen machine would be considered a long-term tangible asset as they plan to use it over many years to help generate revenue for their business. Long-term tangible assets are listed as noncurrent assets on a company’s balance sheet. Typically, these assets are listed under the category of Property, Plant, and Equipment (PP&E), but they may be referred to as fixed assets or plant assets.

But remember, expenses are reflected on your balance sheet in two ways. They can increase a liability account like accounts payable or drawdown an asset account like cash. One of the main differences between expenses and liabilities are how they’re used to track the financial health of your business. There are five types of accounts that show up on both your balance sheet and income statement. Most companies report such items as revenues, gains, expenses, and losses on their income statements.

Firm of the Future

Analyzing and watching out for how you spend your money on a regular basis is a must if you want to get on the road to financial freedom. For example, if you buy a seemingly bad property in an attractive area, eventually someone will want to start building, and your parcel will increase in value. If you negotiate well, the cost of goods sold is minimal in that case.

GDS Holdings Limited Reports Second Quarter 2023 Results – GlobeNewswire

GDS Holdings Limited Reports Second Quarter 2023 Results.

Posted: Tue, 22 Aug 2023 11:00:20 GMT [source]

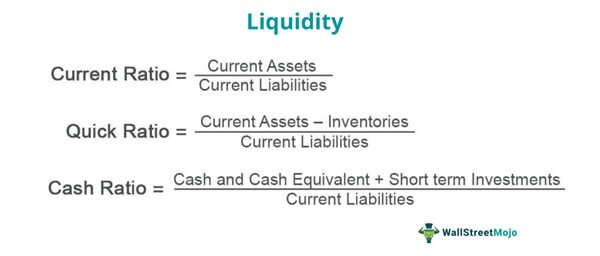

Think of them as tools to help you uncover areas where you can cut costs and increase profits. You can also optimize management practices and compare your business with your competitors. Taking a step back, liabilities are less about day-to-day spending and more about what your company Expenses or Assets owes. This includes any outstanding loans your business has or money that you owe to suppliers. Liabilities can also include wages you owe to your employees, among other things. These are longer-term obligations, though they can be current liabilities or long-term liabilities.

Current Assets

For companies, assets are things of value that sustain production and growth. For a business, assets can include machines, property, raw materials, and inventory—as well as intangibles such as patents, royalties, and other intellectual property. As it is a contra asset account, receiving credits instead of debits, the Accumulated Depreciation account shows up on the Balance Sheet. As its balance increases as the depreciation is taken each year, it lowers the total value of assets on the Balance Sheet. Assets are costlier items with a useful life greater than one year. Also called “Fixed Assets” or “Long-term Assets,” assets can be paid for with Cash, or financed with a loan or mortgage.

They include tangible and intangible things of value gained through the company’s ongoing transactions. You may handle your balance sheet, income statements and cash-flow statements yourself or outsource the duties to an accountant, but regardless, you’ll want to understand how each of these work. Today, we’ll dive into the different account types you need to know and what goes into each. Conversely, a loss is realized whenever a company loses money through secondary activity. If a company sells an asset, the determination of gain versus loss is dependent on the book value of the asset according to the company’s financial documents. A loss will also be recorded if a company is ordered by a judge to pay to settle a lawsuit, or if it loses money on the financial investment.

Are Houses an Asset?

As a result, unlike current assets, fixed assets undergo depreciation. When looking at an asset definition, you’ll typically find that it is something that provides a current, future, or potential economic benefit for an individual or company. An asset is, therefore, something that is owned by you or something that is owed to you. If you loaned money to someone, that loan is also an asset because you are owed that amount.

Looking for more examples of the differences between assets and expenses? Check out this post, where we cover common expenses, business equipment, patents, and more. You don’t take a $3,000 deduction in the year you bought the copier, but instead depreciate its value over time. Depreciation can be accelerated, and your CPA will be able to help you determine whether that’s a good option. You’ll want to keep your receipts for both purchases, but your accountant will need the copier receipt to create the depreciation schedule.

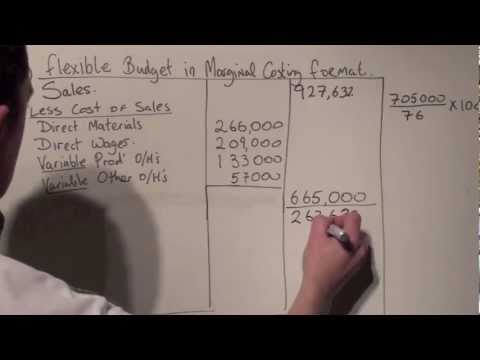

Depreciation allows a company to write off, or “depreciate,” the cost of the asset over its expected life span. To depreciate our $10,000 asset purchase over 5 years using the simple Straight-line Method of Depreciation, we would expense $2,000 each year for 5 years. Expenses are reported on the Income Statement – also called the Profit and Loss Report (P&L). Expenses have a direct effect on taxable income because expenses are subtracted from gross revenue to arrive at net revenue or net income. For an asset to eventually reduce taxable income, it must be depreciated. See Depreciation Expense on the Income Statement below for an example.

Liabilities

An app such as Expensify allows business owners to automate expense reporting, and simply scan receipts from any mobile device to be automatically reported in the books. Cloud-based accounting apps can save small business owners valuable time by eliminating manual double entry. Most importantly cloud-based apps will ensure you don’t miss out on any valuable tax deductions at the end of the year. While a few pens and paper, or office snacks may not sound like much at the moment, those expenses can really add up; meaning more money stays in the business come tax time.

- Liam knows that over time, the value of the machine will decrease, but they also know that an asset is supposed to be recorded on the books at its historical cost.

- Examples of expenses you’re familiar with are office supplies, monthly POS system fees or food expenses for your staff.

- More important, it’s a budgeting tool to minimize fixed costs when times get tough.

- Let’s go over a few examples to give you a better idea of the difference between the two.

- The higher expenses will reduce the profit before tax as well as the income tax expense.

Investing in assets and reducing expenses will build your business’ net worth, make you more viable for a loan and increase your profits over time. Look for ways you can apply this to your business, and you’ll watch your money grow. Expenses are the cost that company spends to support operations and generate revenue. Expenses will be deducted from total revenue to get the net profit.

For a five-year asset, multiply 20 percent (100%/5-year life)×2(100%/5-year life)×2, or 40 percent. Assets can be broadly categorized into current (or short-term) assets, fixed assets, financial investments, and intangible assets. They are bought or created to increase a firm’s value or benefit the firm’s operations. Expenses are not equity rather they cause the owner’s equity to reduce.

In other words, if the item does not have a large impact on your financial statements, you can choose to simply expense it. The materiality principle states that if an expense represents more than 5% of your total assets, it should be recorded as an asset rather than an expense. Asset is a resource available to a business that gives it some form of economic benefit in the future. In comparison, an expense is the amount of resources that have already been consumed in the operations of a business during an accounting period. In general business speak, there’s a good chance you use the words asset and expense interchangeably. In accounting terms, however, assets and expenses are distinctly different.

The expense account increases when a company makes use of funds (a debit) and decreases when funds are credited from another account into the expense account. Therefore, the expense account stores information about different types of expenditures in a company’s accounting records. Just like revenue accounts, expenses are a separate account on the income statement.

Investing in these types of assets is making your money “work” for you, so that your money grows over time, whereas with cash, your money won’t grow, but rather it will lose value. The cost of assets are depreciated over an asset’s expected life span. That means that a portion of the expense can be “written off” each year using one of several depreciation formulas.

- However, Tim still needs to record the purchase of the copier, which is a fixed asset.

- The balance sheet provides a snapshot of how well a company’s management is using its resources.

- For example, an office assistant’s salary will be recorded in the accounting period in which he or she has rendered services for the business.

- The build-up of assets is generally considered to be a pursuit of monetary wealth.

- They are bought or created to increase a firm’s value or benefit the firm’s operations.

Expenses in accounting are recorded through cash basis or accrual basis accounting methods. In cash basis accounting, expenses are only recorded when they are paid. While, in the accrual accounting method, they are only recorded when they are incurred. Expenses can be grouped into two main types in business such as operating and nonoperating expenses. Expenses directly reduce taxable income, but they may be expensed at different times depending on if the company uses the accrual method or cash method of accounting. Each year, the accumulated depreciation balance increases by $9,600, and the machine’s book value decreases by the same $9,600.