Ratios in themselves do not give you definitive answers to questions, but they can highlight when problems are potentially arising, and companies are beginning to struggle. Megha is a content writer with sharp technical skills, owing to her past experience in networking and telecom domains. She focuses on various topics including productivity, remote work, people management, technology, market trends, and workspace collaboration. Join over 2 million professionals who advanced their finance careers with 365.

How to Calculate Liquidity Ratio?

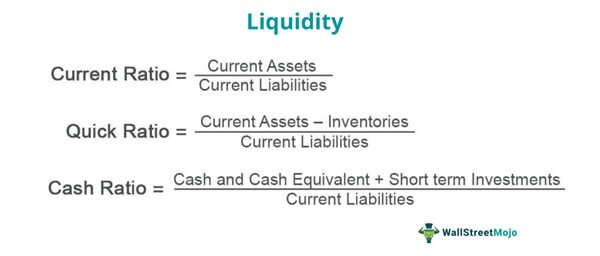

A quick ratio of 1.3 means the company has Rs.1.30 of highly liquid assets available to cover each Rs.1 of current liabilities. This indicates it is in a strong position to meet its short-term obligations without needing to sell inventory or other assets. The cash ratio measures a company’s ability to meet short-term obligations using only cash and cash equivalents (e.g. marketable securities). These ratios offer a quick snapshot of a company’s liquidity position without delving into complex financial analysis. For instance, the current ratio, which divides current assets by current liabilities, can quickly be determined by glancing at a company’s balance sheet.

Salvage Value – A Complete Guide for Businesses

For example, suppose a country has 1,000,000 active duty military personnel and a total land area of 3,000,000 square kilometers; its basic defense ratio would be as given below. Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations. Financial leverage, however, appears to be at comfortable levels, with debt at only 25% of equity and only 13% of assets financed by debt. We can draw several conclusions about the financial condition of these two companies from these ratios. The absolute liquid ratio in this case is 0.75 which is better as compared to rule of thumb standard which is 0.50.

- This provides insight into whether or not a company can meet short-term obligations without relying on inventory sales.

- A result greater than 1 may sound like good news from a liquidity standpoint, but it bears scrutiny on efficiency.

- Stock investors want to see efficient management of working capital through prudent credit terms.

- However, an extremely high ratio may indicate inefficient use of assets.

- The higher the cash ratio, the better for the company since it has sufficient liquid assets to pay off its short-term obligations such as trade payables and short-term loans.

Understanding Liquidity Ratios: Types and Their Importance

They reveal its ability to convert assets into cash quickly to cover current debts without raising external capital. And although they do not provide meaningful insights about businesses’ long-term standing, they are among the first metrics you should check when making investment decisions. For straightforward liquidity ratios, the Current Ratio measures a company’s ability to pay off its short-term debt obligations with its short-term assets. Any figure over 1 means that the company has enough working capital to cover its short-term liabilities with ease. A low figure indicates that the company might have trouble meeting its obligations in the short run.

Quick liquidity ratio

Liquidity is defined as how quickly an asset can be converted into cash. For instance, you can compare Microsoft’s current ratio against Google’s current ratio to gauge how each company may be structured differently. This can be an important part of deciding between companies to invest in, especially if short-term health is one of your primary considerations. There are two main liquidity ratio types commonly used and have been explained below. Liquidity Ratio is a measure used for determining a company’s ability to pay off its short-term liabilities.

If you wish to learn how to calculate these ratios in Excel, download our liquidity ratios template. Then, enroll in our Financial Ratio Analysis am i still responsible for paying a debt if i receive a 1099 course to take your skills to the next level. High liquidity ratios indicate that a firm’s liquid assets exceed its short-term debt.

Cash is a low-yielding asset and high levels of inventory may be an indication it is slow-moving. However, holding excessive cash can also mean a company is not maximizing its investment opportunities. This formula comprises the most liquid assets and high liquid assets in the numerator and hence tends to be more accurate while carrying out liquidity ratio analysis and interpretation. If you are interested in liquidity ratio calculation, then you can either calculate the current ratio or quick ratio depending on what you are interested in learning about a company.

If a company has significant long-term debt, then the long-term debt should be subtracted from the total current assets before calculating the current ratio. One might think that a company should aim for the highest possible liquidity ratios. This means that the company always has sufficient current assets available to meet its short-term liabilities. Some assets counted towards the LCR include cash, central bank reserves, high-rated government securities, and corporate bonds.

Five useful financial ratios besides liquidity ratios are profitability ratios, leverage ratios, valuation ratios, efficiency ratios, and market value ratios. A low turnover like 1 or 2 could mean excess inventory and increased costs. A very high ratio, like 10+, indicates inadequate inventory levels and lost sales.

The SLR aims to control the expansion of bank credit and secure the safety of depositors’ money. It ensures that a portion of bank deposits is invested in liquid assets that can readily be converted into cash to meet any repayment obligations. The statutory liquidity ratio is an essential tool in the RBI’s arsenal to control inflation and prop up the Indian rupee. For investors, a high liquidity ratio is generally preferred as it demonstrates that the company readily converts assets into cash in order to pay off current liabilities if needed. A ratio between 1.0 and 1.5 is usually considered a good liquidity ratio for most businesses. The quick ratio for the year was 0.68, which remains a concern as it highlights the potential difficulty in settling immediate obligations without selling other current assets.